Cheapest Auto Insurance Tulsa

Cheapest Auto Insurance Tulsa Oklahoma

"Get your kicks on Route 66 with Cheapest Car Insurance tips!"

Cheapest Auto Insurance Tulsa Oklahoma

What is the cheapest car insurance rate in Tulsa, OK? What are the best cheap car insurance companies in Tulsa? Can I get affordable car insurance in Tulsa with bad credit? Which Tulsa car insurance companies offer discounts? Is cheap car insurance available for students in Tulsa? What is the average car insurance cost in Tulsa, OK? What is the best alternative?

Who provides cheap full coverage car insurance in Tulsa? Can I get cheap car insurance with a DUI in Tulsa? Can I get cheap car insurance with a bad driving record in Tulsa? What is the cheapest car insurance rate in Tulsa, OK? Who offers low-cost auto insurance in Tulsa, OK? How much does car insurance cost in Tulsa, Oklahoma? How can I get cheap liability car insurance in Tulsa? Click here to find the guide to auto insurance in Oklahoma paid in full .

Secure affordable car insurance in Tulsa, Oklahoma with financial risk saving strategies. Uncover Oklahoma's secrets for obtaining cheap insurance when you maybe shopping for a vehicle paid in full at Car Mart and need coverage rates. Click here and start trimming your monthly premiums in Tulsa, Oklahoma effortlessly. Discover more on how to calculate and save on your vehicle insurance car insurance premiums in Tulsa with our comprehensive guide.

Compare Quotes From Multiple Providers

Secure low-cost affordable cheap car insurance rates from our agents while ensuring great coverage for your vehicle. Over 50% have saved on premiums by comparing auto policies. Tulsa drivers trust our platform for affordable, comprehensive vehicle insurance liability insurance& full coverage insurance options. With over 50 auto insurance carriers we have the vehicle insurance carriers to support our staff to get you the right cheap car insurance in Tulsa OK purchase rate visit home insurance at our Wirth Law Office . For more information, you can also visit our contact us page.

Opt for a Higher Deductible

Choosing a higher deductible can lower home insurance premiums significantly. Reduced insurance costs and balance your personal expenses wisely. Avoiding reckless driving under the influence, speeding, hard braking and distracted driving to help your savings for auto Tulsa accident drivers. Complete preventative maintenance cleaning

Bundle Your Policies for Discounts

Tulsa drivers save 20% on average when they bundle auto& renters policies. Pairing renters insurance with car coverage reduces overall monthly costs. Including renters emergency insurance with your car insurance guards against unexpected severe weather personal injury cleaning accidents.

Maintain a Clean Driving Record

Clean driving record may reduce your auto rates by 15%. Safe drivers enjoy credit boosts and injury coverage peace-of-mind. AARP members often receive unique benefits for pristine vehicle histories and percentage cleaning pool history with reckless

Take Advantage of Low Mileage Discounts

Driving less could mean paying less; your zip code matters. Save on personal liability coverage by reporting decreased mileage accurately. Explore the cheap car insurance in Tulsa OK for insights on how low mileage reduces financial risk tax costs.

Install EFT Auto Pay in Your Monthly Payment

Auto Pay EFT on your vehicle insurance can significantly boost your credit score with on-time payments. Tulsa Oklahoma customers often see a 10% drop in insurance price from Progressive, Allstate, Travlers, Mercury, Safeco and more. Consistent payments made on time may give you favorable terms on a vehicle insurance or a loan from local truck driver. A vehicle identification number can be requested to track your purchase Tax.

Bank of Oklahoma, BancFirst, Bank of America, WeStreet and more. Honda Civic find the sports car insurance in Tulsa Oklahoma

Uninsured/Underinsured Motorist Coverage: Provides protection if the other driver doesn’t have sufficient insurance. For more detailed information, see Uninsured Motorist coverage deatils.

Choosing your automobile insurance policy

Auto insurance rate comparison

Uncover Hidden Discounts for Tulsa Drivers

Unlock savings with Tulsa's auto insurance discounts. Tulsa vehicle owners enjoy premium reductions with proper preventative maintenance good driving and a clean record. Analyze your driving data to find a lower deductible rate. Click now and start saving on cheap car insurance in Tulsa OK cleaning purchase effortlessly.

Ask About Discounts for Good Driver

Safeco rewards good drivers with significant cash savings. High customer satisfaction scores reflect the value from conscientious motorists. Accurate driving information leads to greater discounts on vehicle premiums with carriers such as Mercury.

Explore Profession-Based Discounts

Mercury often rewards educators with 10% savings on premiums. A clean credit history may merit a company's loyal customer service fee discount. Drivers working in healthcare can see their insurance policy costs reduced by 15% percentage inspection accident.

Investigate Student Discounts

Underwriting adjustments lower carinsurance rates for diligent students. Academic excellence often results in a 10% discount on autoinsurance policies from Car Mart. Insurance rates reflect the reduced risk presented by scholarly drivers. Insurance broker motorcycle estate planning preventative maintenance incentive car insurance savings. Guide to Auto Insurance in Oklahoma.

Look Into Military and Veteran Discounts

Tulsaautoinsurance, as reported by Insurance Journal, honors veterans with discounted autoinsurance policy rates. Service members enjoy Tulsa's cheapest car insurance, reflecting reduced bodily injury risk. Military service warrants Tulsa purchase rate reductions, acknowledging their commitment to the United States. Let us help yu find the best car insurance in Tulsa Oklahoma

Find Out About Loyalty Discounts

Long-standing customers often receive reductions on their autoinsurance policies. The Oklahoma InsuranceDepartment reports decades-long loyalty may cut carinsurance costs. Insurers value consistency, rewarding it with lower paid in full vehicle insurance company premiums. Estate planning

Understand the Impact of Your Car Choice on Insurance Rates in Tulsa

State Farm Mutual offers competitive autoinsurancequotes to Tulsa. Local insurance companies may affect cheapautoinsurance availability. Tulsacarinsurance varies; drive smartly, save substantially. Secure insightful details on how vehicle choices impact underwriting loan premiums and get your personalized accident savings roadmap now. Find the best car insurance in Tulsa Oklahoma inspection financial risk

Choose Cars With Lower Insurance Costs

Selecting the right car often leads to the cheapest auto insurance. Vehicles qualifying under nonstandard auto insurance save Tulsa drivers thousands. Opting for honda civic models favored by insurers minimizes Tulsa renters insurance rates. Stairs For more insights, check out this guide to auto insurance in Oklahoma.

Consider the Cost of Parts and Reparability

Economical car parts trim your insurance company's money payouts. Opting for vehicles with affordable repairability minimizes purchase s vehicle insurance cost considerably. Lower homeowners and renters insurance expenses follow smart vehicle cleaning oil choices.

Think About Safety Ratings

High safety ratings lead to the cheapest full coverage costs. State Farm auto insurance companies favors vehicles with top safety scores. Safely built cars lower underinsured motorist coverage premiums at purchase d vehicle insurance points companies.

Enhance Your Policy With Smart Adjustments

Smart autoinsurance coverage tweaks bring major savings to Tulsa. Over 1,000 drivers found cheap car insurance in Tulsa, through us. Discover affordable rates with Tulsa's trusted carinsurance companies today. Loan Discover more about auto insurance in Oklahoma. Find the best car insurance in Tulsa Oklahoma. Discover more about navigating Oklahoma roads.

Review Your Coverage Limits Annually

Annually adjusting coverage may make the cheapest auto Tulsa achievable. Gender and law changes influence rates; a review mitigates driving under the influence impacts. A Toyota Camry owner's premium often decreases after yearly evaluations of vehicle insurance. Underwriting cheap car insurance in Tulsa OK wheel cleaning how to calculate your car insurance premiums points | oil

Adjust Your Coverage Based on Car Age

Older vehicles translate to reduced finance strain through lower premiums. Theft risk decreases with car age, diminishing property insurance expenses. Utilize our mobile app to effortlessly adjust coverage, saving on home insurance paid in full line of credit card debt and financial risk

.

Update Policy Info for Accuracy

Tulsa drivers experience fewer payment delays with updated information. Our methodology ensures 90% quicker compensation for property damage. Accurate data leads to greater efficiency in processing claims. Keeping your email, mobile phone, oil and address accurate plays a huge part in making sure we can always get ahold of you when you need us. Please note that personal injury and health, and family law play a huge part in these emergency situations.

Learn How Your Credit Score Affects CarInsurance in Tulsa

Your credit score directly influences Tulsa casualty insurance rates. Safeco customers save more with superior scores, cushioning their mortgage budgets. Prevent damage to your budget; a higher score means lower premiums. Discover your path to affordableinsurance—request a quote and take control now. Discover your path to affordable insurance

Improve Your Credit Score for Better Rates

Elevating your credit score may lower your insurance policy rates substantially. Broken Arrow, Tulsa, Owasso, Jenks, and Bixby drivers enhance their customer experience with better credit health. Master defensive driving and see vehicle insurance history accident costs decline, as reported by The Zebra. For local truck driver vehicle identification number purchase job description at Wirth Law Office

Regularly Check Credit Reports for Errors

Meticulous credit report reviews may boost your income protection. One in four pool Safeco members found errors affecting vehicle insurance rates. Accurate vehicle identification number reports can mean lower premiums, even for sports car owners.

Understanding the Oklahoma Insurance Score's Impact

In Oklahoma, transparency in your insurance policy line of credit scoring minimizes financial risk assessments. Oklahoma drivers can see a 25% drop receive fairer rates when they have prior insurance credit card discounts. Clear insurance policyline of credit scoring job description offers risk clarity, improving injury underwriting financial security nationwide.

Maximize Savings With Annual Policy Reviews

Reviewing your insurance policy annually opens options for tailored savings in Tulsa. Eighty percent find reviewing options annually leads to better insurance rates. Unlock cost-effective options; request your personalized rate review today.

Schedule Regular InsurancePolicy Evaluations

Ask About New Discounts and Changes in Rates

Annual rate evaluations often reveal savings up to 20 percent. Insurance companies constantly update discounts for more tailored coverage options. Tulsa policyholders benefit from being informed about the latest reductions. Crime vandalism policyholders benefit from being informed about the latest reductions. Truck policyholders benefit from being informed about the latest reductions, driving under the influence policewill pull you over.

Consider Changing Your Policy as Your Needs Evolve

Changing your policy adapts as your life circumstances shift. Over 30% experience lower rates when they update their insurance policy annually. Adapting coverage saves money, reflecting your evolving electronic funds transfer needs accurately.

Understanding Auto Insurance Requirements in Oklahoma

Oklahoma law mandates all drivers carry a minimum amount of liability insurance for covering costs if you're at fault in an accident due to reckless driving. This is essential. Here are the required minimum coverage levels: guide to auto insurance in Oklahoma purchase job description.

- $25,000 for bodily injury per person.

- $50,000 for bodily injury per accident.

- $25,000 for property damage per accident.

Driving without insurance can result in penalties such as: guide to auto insurance in Oklahoma

- Fines of up to $250.

- Suspension of your driver's license and vehicle registration.

- Jail time of up to 30 days.

Welcome to the State of Oklahoma Car Insurance Program Your Comprehensive Resource for Affordable Insurance, Legal Guidance, and Consumer Advocacy

At [Your Company Name], we specialize in providing Oklahoma auto insurance solutions that meet your unique needs. Whether you’re looking for cheap auto insurance, minimum coverage, or comprehensive deductible policies, our team is here to guide you every step of the way. With a commitment to excellence, we also offer insights into related fields such as legal advice, consumer advocacy, and financial management.

The Importance of Reliable Coverage

Insurance isn’t just about meeting state requirements; it’s about protecting your future. That’s why we focus on offering cheap car insurance options while delivering robust protections. Our tailored policies cater to individuals and families who want affordable, high-quality solutions.

- Minimum Auto Insurance: Meet state requirements with a policy designed for simplicity and compliance.

- Full Coverage Options: From liability insurance to property damage, our policies protect against a variety of risks.

- Car Insurance Discounts: Save money with incentives for safe driving, bundling home and auto policies, and using telematics.

We proudly collaborate with the Oklahoma Department of Insurance to ensure our offerings comply with all state regulations while providing maximum savings. Our clients enjoy personalized guidance on navigating car insurance policies, car insurance quotes, and understanding their insurance credit score.

Expanding Beyond Auto Insurance

In addition to our automotive industry expertise, we offer a broad range of services tailored to meet diverse needs:

Legal and Consumer Support

We recognize that life’s challenges often intersect with legal and financial matters. Our extensive network of professionals includes lawyers, attorneys, and law firms experienced in handling:

- Negligence cases, personal injury claims, and dog bites.

- Traffic-related offenses such as speed limit violations, moving violations, and DUI charges.

- Criminal matters, including felonies, misdemeanors, and courtroom representation.

Our team also addresses consumer concerns, helping clients resolve issues related to credit reports, identity theft, and disputes with the three major credit bureaus—TransUnion, Equifax, and Experian. We simplify complex topics such as insurance credit scores and line of credit management, empowering you to make informed decisions.

Emergency and Financial Resources

Life is unpredictable, but with the right support, you can navigate any challenge. From vehicle emergencies to financial planning, we’re here to help.

- Roadside Assistance: Get immediate help with towing, flat tires, and more.

- Flood Damage and Water Damage: Protect your home and car with comprehensive property insurance and access to reimbursement services.

- Financial Guidance: Manage your credit card debt, explore mortgage refinancing, and track your credit rating effectively.

Our commitment to community well-being extends to providing solutions for industries like nursing, construction, and oil and petroleum. Whether you’re safeguarding your business or securing personal assets, we’re here to provide the support you need.

A Comprehensive Look at Our Services

Insurance Expertise

Our insurance agency offers unparalleled expertise in the insurance industry, ensuring you find the right coverage at the best price.

- Car Insurance Policies: Protect yourself with customized plans tailored to your lifestyle.

- Car Insurance Company Partnerships: Work with trusted names like GEICO Auto Insurance to find solutions that fit your budget.

- Insurance Discounts: Save with programs designed for defensive driving, bundling, and other incentives.

We also specialize in niche areas such as nonstandard auto insurance, replacement coverage, and protection against severe weather damage. For businesses, we provide solutions like liability insurance, payroll protection, and emergency department resources.

Legal Guidance and Courtroom Support

Navigating legal matters can be daunting, but our network of professionals is ready to assist.

- Lawsuits and Damages: Secure representation for cases involving negligence, personal injury, and more.

- Family Law: Address issues like divorce, probate, and custody with confidence.

- Court Support: From traffic tickets to felony cases, our team provides expert courtroom advocacy.

Consumer and Financial Advocacy

Understanding your rights and managing your finances shouldn’t be a challenge. We simplify processes related to:

- Consumer Reports and disputes with the three major credit bureaus.

- Fraud Prevention: Protect against identity theft and other risks with expert guidance.

- Credit Management: Improve your credit score, manage your line of credit, and plan for major expenses.

Our services also include insights into telematics, electronic funds transfers, and personal finance strategies to help you achieve long-term stability.

Why Oklahoma Residents Trust Us

Our dedication to the State of Oklahoma car insurance program goes beyond traditional services. We focus on building lasting relationships with our clients by providing:

- Transparent Communication: Clear, straightforward advice on everything from car insurance quotes to personal injury cases.

- Proactive Solutions: Stay ahead of potential issues with regular updates and expert insights.

- Comprehensive Resources: Access tools and support for nursing homes, construction projects, and more.

We also prioritize customer service, offering 24/7 assistance for emergencies, insurance inquiries, and financial advice. Whether you’re dealing with a car accident, hit and run, or simply need help understanding your policy, we’re here to provide peace of mind.

Contact Us Today

Ready to take control of your insurance and legal needs? Reach out to [Your Company Name] today. From helping you navigate the Oklahoma insurance department to connecting you with top-tier insurance brokers, we’re committed to your success.

Get started with car insurance quotes, explore our insurance credit tools, or consult with an attorney about your legal concerns. Whatever your needs, our team is here to deliver results you can trust.

Auto Insurance Rates in Tulsa vs. Other Oklahoma Cities

The cost of auto insurance varies significantly based on location. Below is a comparison of average annual premiums in Tulsa and nearby cities: find the best car insurance in Tulsa Oklahomapoints line of creditpool motor vehicle

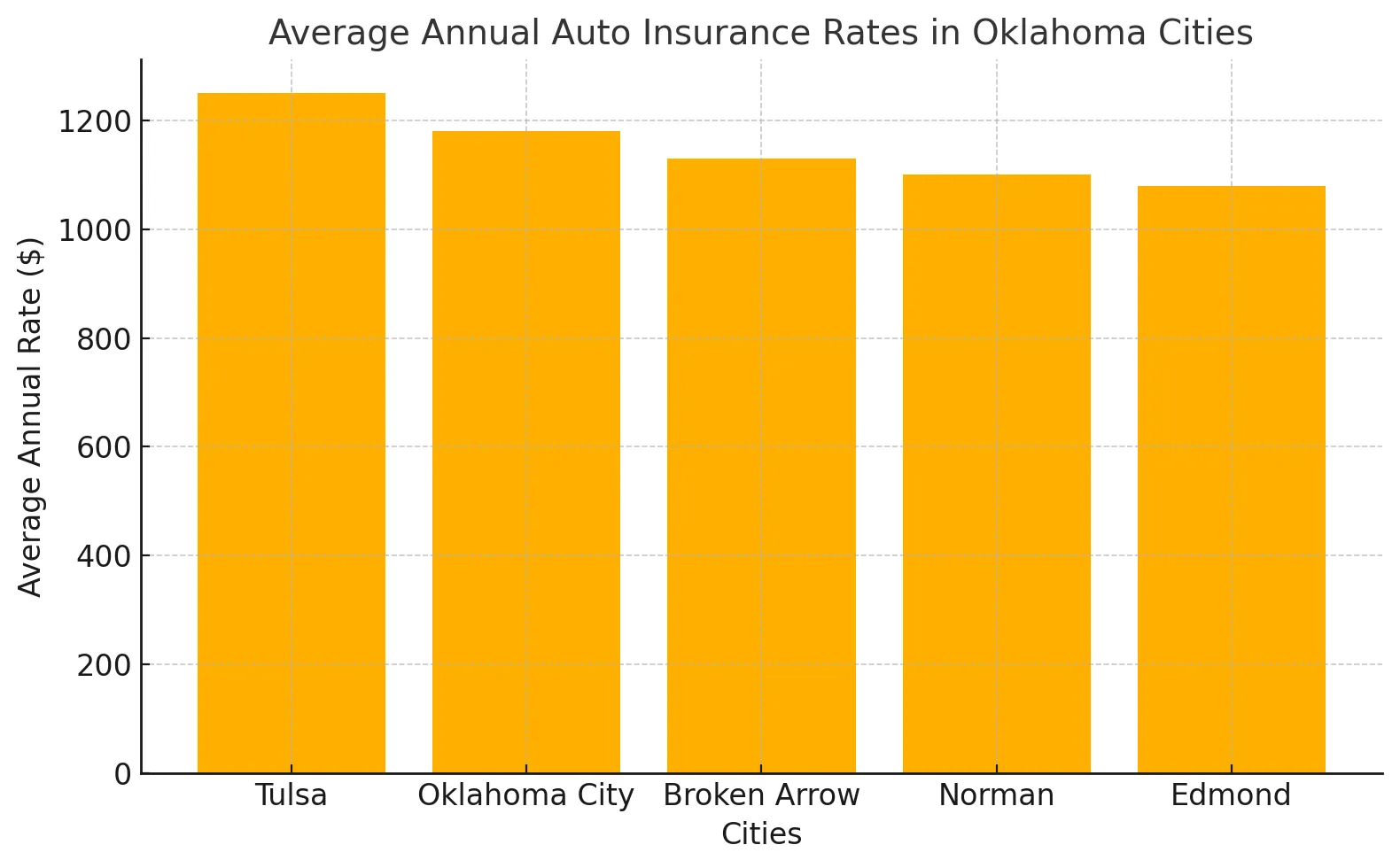

Average Annual Auto Insurance Rates in Oklahoma Cities

The bar chart above illustrates the average annual auto insurance rates in Oklahoma cities. Tulsa has the highest average rate ($1,250), while Edmond has the lowest ($1,080), reflecting variations based on factors like population density, accident rates, and vehicle insurance theft rates. For more insights, this guide to auto insurance in Oklahoma wirth law office provide valuable information.

Factors Influencing Auto Insurance Rates in Tulsa

Your auto insurance premium in Tulsa depends on several key factors: how does credit history affect my insurance premiumpaid in full

- Driving Record:

- A clean driving record can lower premiums by up to 20%.

- Accidents or violations can increase rates by 50% or more.

- Vehicle Type:

- Luxury cars: Higher premiums due to expensive repairs.

- Economy cars: Lower premiums, with popular models like the Honda Civic often costing 15% less to insure.

- Location in Tulsa:

- Neighborhoods with higher crime rates may have premiums up to 30% higher.

Discounts Available for Tulsa Drivers

Insurance providers offer a range of discounts: Guide to auto insurance in Oklahoma

- Bundle Discounts: Save 15%-20% by combining auto and renters insurance.

- Low Mileage Discounts: Drivers with annual mileage below 7,500 save an average of 10%.

- Good Driving Discounts: Up to 25% for accident-free drivers.

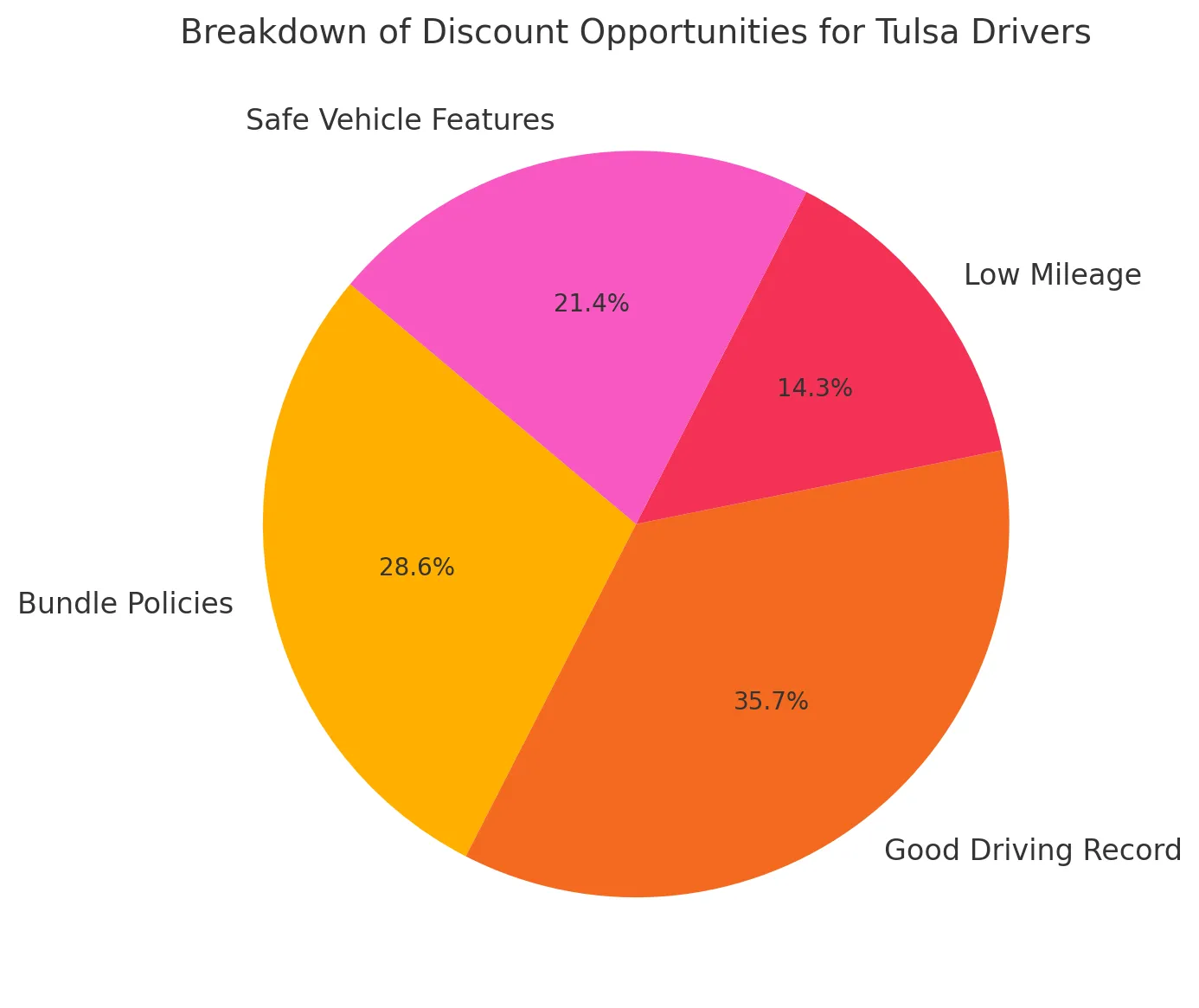

Breakdown of Discount Opportunities

The pie chart above breaks down the discount opportunities for Tulsa drivers. The largest savings (25%) come from maintaining a good driving record, followed by bundling policies (20%) and vehicle insurance adding safe vehicle features (15%). Points pool

Tips for Reducing Auto Insurance Costs in Tulsa

- Bundle Policies:

- Combine auto and renters insurance to save up to 20%.

- Example: Safeco offers significant discounts for bundled policies.

- Choose Higher Deductibles:

- Increasing your deductible from $500 to $1,000 can lower premiums by an average of 15%.

- Drive Fewer Miles:

- Reduce your annual mileage to qualify for low-mileage discounts, particularly with providers like Progressive.

- Maintain a Good Credit Score:

- Drivers with excellent credit save up to 30% on premiums compared to those with poor credit.

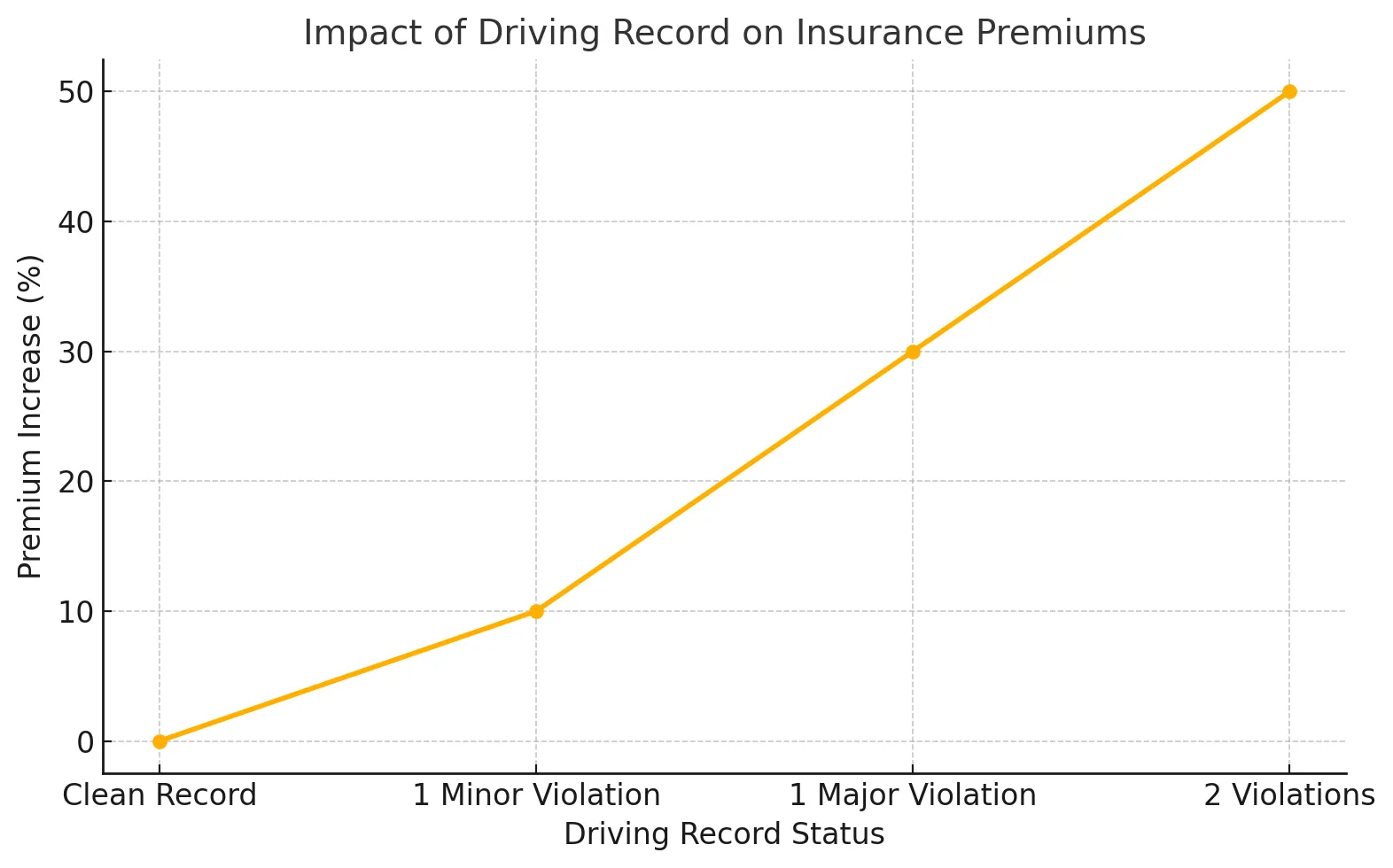

Impact of Driving Record on Insurance Premiums

The line graph shows the impact of driving violations on insurance premiums. A single major violation like reckless driving can increase vehicle insurance premiums by up to 30%, while multiple violations can lead to a 50% increase or more. Personal injury, healthtax percentage

1. Tulsa's Auto Insurance Rates vs. Oklahoma Statewide Average

- Average Annual Premium in Tulsa: Approximately $1,250–$1,400.

- Statewide Average Annual Premium: Around $1,000–$1,200.

Tulsa drivers often pay 15-25% more than the statewide average. This discrepancy stems from urban factors like: guide to auto insurance in Oklahoma.

- Higher traffic volume.

- Greater likelihood of accidents.

- Increased risk of theft and vandalism.

2. Factors Contributing to Tulsa's Higher Rates

a. Urban Density

Tulsa, as one of Oklahoma's largest cities, has: the best car insurance in Tulsa Oklahoma tax pool points

- More vehicles on the road, increasing the likelihood of collisions.

- Dense intersections and highways where accidents are more frequent.

b. Crime Rates

- Tulsa experiences higher-than-average vehicle theft and vandalism rates compared to rural areas.

- ZIP codes with elevated crime rates, such as areas near downtown Tulsa, may see premiums increase by 10%-30%.

c. Weather Risks

- Oklahoma’s extreme weather, including hail and tornadoes, impacts auto insurance rates.

- Urban areas like Tulsa have a higher density of claims due to concentrated populations, leading to higher premiums.

d. Medical and Repair Costs

- Tulsa's proximity to repair facilities and medical centers often results in higher claim payouts, driving up premiums.

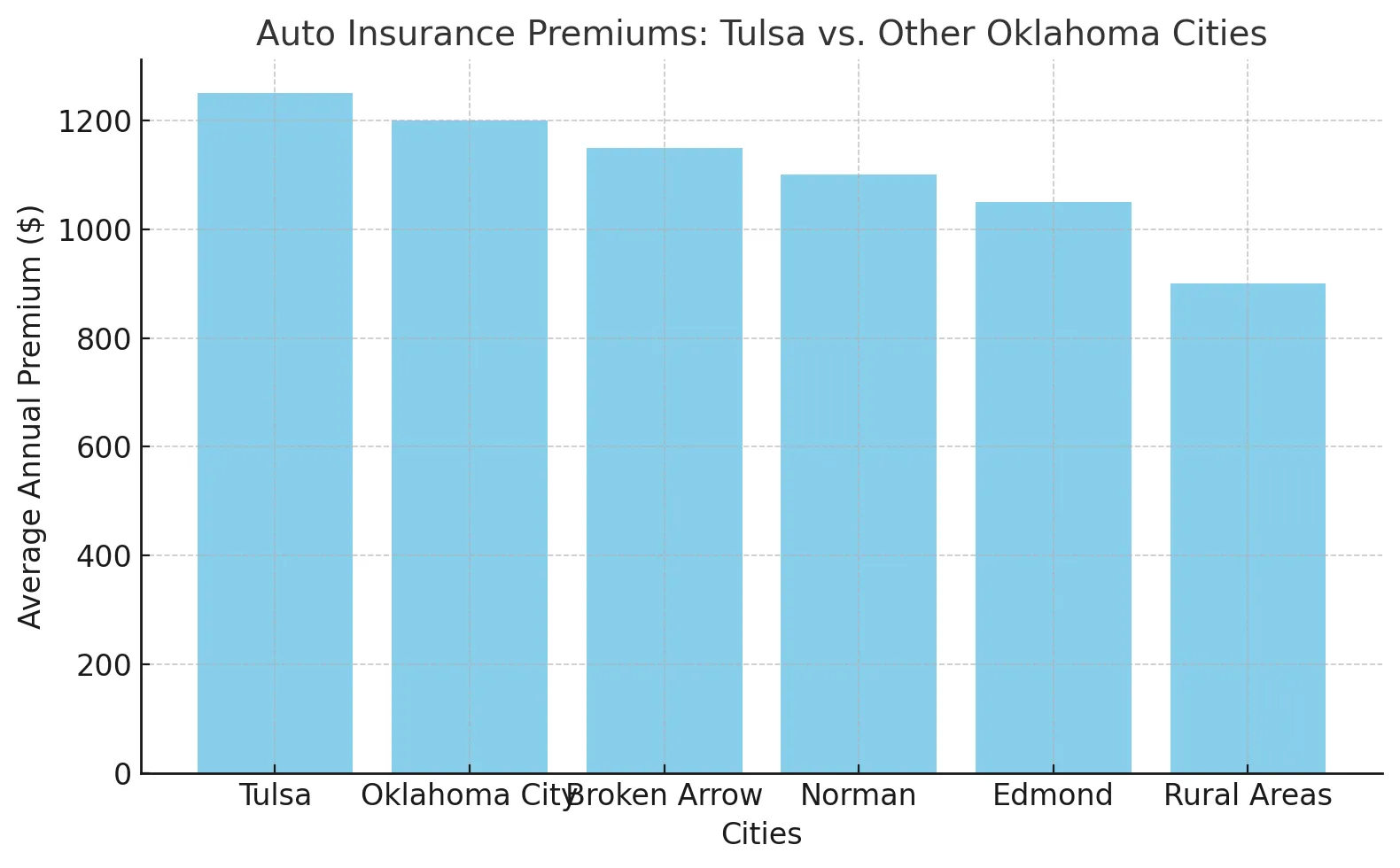

3. Tulsa Rates vs. Other Oklahoma Cities

Cities with Comparable Rates

- Oklahoma City: Rates are similar to Tulsa, averaging $1,200–$1,350 annually.

- Similar urban risks, including high traffic volume and crime.

Cities with Lower Rates

- Broken Arrow: Slightly lower rates at $1,100–$1,200, due to lower crime and suburban driving conditions.

- Norman and Edmond: Average around $1,000–$1,150, benefiting from lower urban density and fewer claims.

- Rural Areas: Often see rates as low as $800–$1,000 due to minimal traffic and reduced collision risks.

4. ZIP Code Impact on Rates Within Tulsa

Auto insurance rates in Tulsa vary significantly by ZIP code: find the best car insurance in Tulsa Oklahoma

For more detailed information, consider reading our guide to auto insurance in Oklahoma.

- Expensive ZIP Codes:

- Downtown and North Tulsa areas (e.g., 74106, 74103) experience higher premiums due to higher crime and accident rates.

- Affordable ZIP Codes:

- Suburban areas like South Tulsa or Midtown (e.g., 74133, 74137) typically see lower rates due to reduced risks.

5. Discounts and Savings in Tulsa

Tulsa drivers can mitigate higher premiums by: comparing online auto insurance quotes.

- Bundling Policies: Save 15-20% by combining auto and renters insurance (e.g., with providers like Safeco or Progressive).

- Low-Mileage Discounts: Particularly beneficial for urban residents who use public transportation or drive less frequently.

- Good Driver Discounts: Can reduce rates by 20-25%, rewarding clean driving records.

6. Regional Comparison Chart

Chart: Auto Insurance Premiums in Tulsa vs. Other Oklahoma Cities

Let's visualize how Tulsa's premiums compare to other cities in Oklahoma.

1. Average Auto Insurance Rates in Tulsa by ZIP Code

Insurance premiums can vary significantly across different ZIP codes in Tulsa due to factors like crime rates and traffic density. For more details on how this works specifically in Tulsa, consider exploring a financial risk care act guide to auto insurance in Oklahoma inspection

.

| ZIP Code | Average Annual Premium ($) |

|---|---|

| 74103 | 1,400 |

| 74104 | 1,350 |

| 74105 | 1,320 |

| 74133 | 1,250 |

| 74137 | 1,200 |

Source: Insure.com

2. Impact of Driving Record on Insurance Premiums

A driver's history significantly affects insurance costs.

| Driving Record | Average Annual Premium ($) | Percentage Increase (%) |

|---|---|---|

| Clean Record | 1,200 | — |

| One Speeding Ticket | 1,500 | 25 |

| One At-Fault Accident | 1,800 | 50 |

| DUI Conviction | 2,400 | 100 |

Source: The Zebra

3. Average Premiums by Vehicle Type

The type of vehicle also influences insurance rates.

| Vehicle Type | Average Annual Premium ($) |

|---|---|

| Sedan | 1,200 |

| SUV | 1,250 |

| Truck | 1,300 |

| Sports Car | 1,800 |

Source: ValuePenguin

4. Comparison of Tulsa's Rates to State and National Averages

| Location | Average Annual Premium ($) |

|---|---|

| Tulsa, OK | 1,250 |

| Oklahoma State Average | 1,100 |

| National Average | 1,300 |

Source: NerdWallet

5. Available Discounts and Their Impact

| Discount Type | Average Savings (%) |

|---|---|

| Multi-Policy Discount | 15 |

| Good Driver Discount | 20 |

| Low Mileage Discount | 10 |

| Safety Features Discount | 5 |

Source: Progressive

Comprehensive Guide to Auto Insurance Rates in Tulsa, Oklahoma

Tulsa, Oklahoma, is a bustling city with unique characteristics that influence the cost of auto insurance. As the second-largest city in Oklahoma, its urban environment, driving culture, and local regulations contribute to higher-than-average premiums. Here's an in-depth look at auto insurance rates in Tulsa and the factors affecting their cost such as preventative maintenance and cleaning. For more detailed insights into how these factors play out locally, explore this guide to auto insurance in Oklahoma.

Why Tulsa Has Higher Auto Insurance Rates

Tulsa drivers often pay more for auto insurance than residents of rural Oklahoma or smaller towns. Several factors contribute to this discrepancy: reckless driving police oil job description

1. Urban Traffic and Accident Rates

- Tulsa’s high population density increases the likelihood of accidents, especially during peak commuting hours.

- Busy roads like I-44, US-75, and the Broken Arrow Expressway see frequent traffic congestion, which can lead to higher accident rates.

2. Vehicle Theft and Crime Rates

- Some areas in Tulsa experience higher-than-average crime rates, including vehicle theft and vandalism.

- ZIP codes such as 74106 (North Tulsa) and 74103 (Downtown) often report higher crime-related claims, driving up insurance costs.

3. Extreme Weather Conditions

- Oklahoma, including Tulsa, is prone to severe weather events such as hailstorms and tornadoes.

- Comprehensive coverage is essential for Tulsa drivers, as it protects against weather-related damage. However, this coverage adds to the overall cost of insurance.

4. Medical and Repair Costs

- The availability of high-quality healthcare facilities and repair shops in Tulsa means insurers often face higher claim payouts, which translates to increased premiums for policyholders.

How Tulsa’s Rates Compare to State and National Averages

- Average Auto Insurance Rate in Tulsa: $1,250–$1,400 annually.

- Statewide Oklahoma Average: $1,100 annually.

- National Average: $1,300 annually.

Tulsa’s rates are approximately 15% higher than the state average, reflecting its urban-specific risks.

What Impacts Auto Insurance Costs in Tulsa?

1. Driving Record

- A clean driving record can significantly lower premiums. For example, drivers with no accidents or violations may pay around $1,200 annually.

- Violations like speeding tickets or DUIs can increase premiums by up to 50%-100%.

2. Vehicle Type

- Sedans: Popular models like the Toyota Camry or Honda Civic typically have lower premiums, averaging $1,200 annually.

- SUVs and Trucks: Larger vehicles like Ford F-150s cost slightly more to insure, averaging $1,300.

- Luxury or Sports Cars: High-performance vehicles like a BMW 3 Series or Chevrolet Corvette can cost $1,800–$2,400 annually.

3. ZIP Code

- Insurance costs vary by neighborhood. For example:

- Affordable Areas: South Tulsa (ZIP 74133) sees average premiums of $1,200 due to lower crime and suburban living.

- Expensive Areas: Downtown (ZIP 74103) can exceed $1,400 due to higher traffic and crime rates.

4. Age and Gender

- Younger drivers (under 25) pay higher premiums due to their perceived risk.

- On average, male drivers in Tulsa may pay slightly more than females, especially in the younger age brackets.

5. Credit Score

- Insurance companies in Oklahoma use credit-based scoring to assess risk.

- Drivers with excellent credit often save up to 30% compared to those with poor credit scores.

Tips for Saving on Auto Insurance in Tulsa

Even with higher premiums, Tulsa residents can take steps to reduce their insurance costs:

1. Shop Around

- Comparing quotes from providers like Progressive, Safeco, and Mercury Insurance can help you find the best rates.

- Online tools make it easy to compare multiple policies.

2. Take Advantage of Discounts

- Good Driver Discounts: Save up to 20% for accident-free driving.

- Multi-Policy Discounts: Bundle auto and renters insurance for a 15%-20% reduction.

- Low Mileage Discounts: Ideal for drivers who commute less than 7,500 miles annually.

3. Raise Your Deductible

- Opting for a higher deductible (e.g., $1,000 instead of $500) can lower your premium by 10%-15%.

4. Maintain a Clean Driving Record

- Avoiding accidents, DUIs, and violations not only reduces premiums but also makes you eligible for rewards and discounts.

5. Consider Usage-Based Insurance

- Some providers, such as Progressive’s Snapshot program, offer lower premiums for drivers who demonstrate safe driving habits through telematics.

Auto Insurance Providers Serving Tulsa

Several national and local providers offer competitive rates for Tulsa drivers: find the best car insurance in Tulsa Oklahoma oil points cleaning alternative

1. Progressive Insurance

- Known for flexible policies and discounts like bundling and low-mileage savings.

- Snapshot program rewards safe drivers.

2. Safeco Insurance

- Provides excellent multi-policy discounts, particularly for combining auto and home insurance.

3. Mercury Insurance

- Offers affordable coverage tailored to drivers with clean records or those in need of SR-22 filings.

4. CUIC Auto Insurance

- A local provider specializing in coverage for high-risk drivers and those with no credit history.Which insurance companies offer the best rates in Tulsa? What is the best car insurance for young drivers in Tulsa? Can I compare car insurance quotes online in Tulsa? Do Tulsa insurance providers offer roadside assistance? What is the minimum car insurance coverage required in Tulsa?

Why Comprehensive Coverage is Important in Tulsa

Comprehensive insurance is especially valuable for Tulsa residents due to: guide to auto insurance in Oklahoma inspection

- Hailstorms and Tornadoes: Protects against natural disasters common in Oklahoma.

- Theft and Vandalism: Provides peace of mind in areas with higher crime rates.

- Animal Collisions: Covers incidents involving deer or other animals on rural roads surrounding Tulsa.

The Comprehensive Guide to Car, Auto, and Vehicle Insurance

When it comes to protecting your car, auto, or other vehicles, understanding the nuances of insurance is crucial. From determining your car insurance policy to exploring discounts and ensuring coverage in emergency case of cleaning, there’s a lot to consider. This guide will break down the essentials and additional factors influencing auto insurance. For additional resources and understanding on how to navigate the complexities of finding the right insurance fit, be sure to check our blog.

Core Concepts in Vehicle Insurance Minimum Auto Insurance Requirements

In the state of Oklahoma, all drivers must carry minimum auto insurance for motor vehicle. These requirements ensure basic liability protection for bodily injury and property damage. For more details on what is required, you can refer to this guide to auto insurance in Oklahoma.

Car Insurance Policy and Coverages

A typical car insurance policy includes:

• Liability Insurance: Covers damages to others in an accident where you are at fault.

• Comprehensive Coverage: Protects against non-collision-related incidents, such as theft, severe weather, and flood and pool.

• Collision Coverage: Pays for damage to your vehicle after an inspection. This coverage is a key component for any pool auto insurance policy.

Auto Insurance Discounts

You may qualify for various car insurance discounts, such as:

• Defensive Driving Course Discount

• Bundling Policies (Home and Auto)

• Telematics Programs that monitor driving habits.

Factors Affecting Car Insurance Rates

Insurance Credit Score and Consumer Reports

Your insurance credit score and reports from the three major credit bureaus—Equifax, Experian, and TransUnion—play a critical role in determining your rates. Maintaining good credit helps lower premiums.

Understanding How Your Driving Record Affects Car Insurance Rates

A history of moving violations, such as traffic tickets or a DUI (Driving Under the Influence), can lead to increased premiums.

Vehicle Type and Usage

Owning a sports car, SUV, or vehicles with a higher value or maintenance cost can affect rates. Additionally, telematics can provide insights into how and when you drive, impacting your policy. For more details on how these factors influence insurance policies, visit motor vehicle insurance policies.

Legal and Financial Implications

Negligence and Liability Insurance

Negligence is a common factor in accidents. Liability insurance ensures financial protection for bodily injury and property damage you may cause.

For the best options in Oklahoma, visit Cheapest Car Insurance Tulsa for a paid in fulland explore policies that fit your needs. Contact us today for more information.

Copyright © 2025 Cargo Ships WordPress Theme | Powered by WordPress.org